Yield Farming: Top Strategies, Risks & Security Tips

Yield farming has become a cornerstone of the DeFi revolution, allowing savvy investors to earn passive income by strategically using their cryptocurrency assets. But as with any high-reward opportunity, it comes with its share of risks.

In this guide, we'll explain everything you need to know about yield farming, from basic concepts to advanced strategies and how to navigate the risks involved.

What Is Yield Farming?

Yield farming is a DeFi investment strategy in which investors stake, lend, or lock up cryptocurrency assets to earn a return on investment (ROI) on their holdings. Due to its volatile nature, it is considered a high-risk investment.

These returns usually come in the form of governance rewards, transaction fees, and/or other crypto assets. Fundamentally, the primary purpose of yield farming is to improve liquidity available in DeFi protocols and allow DEXs and other platforms to function efficiently.

Unlike traditional banking, where institutions control the flow of money, DeFi operates on decentralized principles, relying on smart contracts—self-executing pieces of code—to automate transactions. This decentralized approach has fueled massive growth in the DeFi space.

According to DeFiLlama, the total value locked (TVL) in DeFi protocols has fluctuated significantly, growing from just $600 million in 2020 to around $170 billion in November 2021 and currently sitting at approximately $107 billion as of February 2025. These figures show just how much money is flowing into DeFi, looking for those high yields.

Roles in Yield Farming

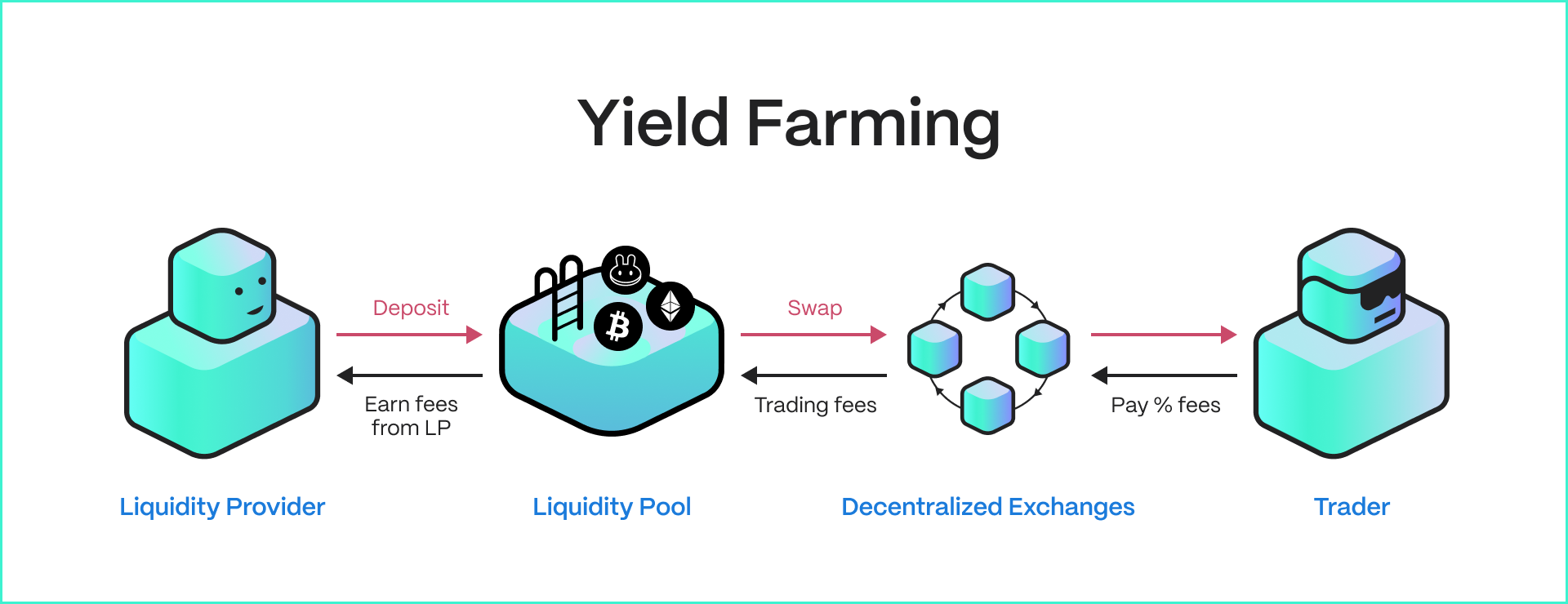

Yield farming requires multiple participants to work in unison through a decentralized system, each playing an important role in the ecosystem to ensure all financial processes run smoothly.

Liquidity Providers (LPs)

LPs deposit token pairs into liquidity pools on platforms like Uniswap to enable decentralized trading for the platform’s users. For example, a user would deposit $1000 in the stablecoin USDC and $1000 of a chosen token (such as UNI), allowing traders to buy and sell UNI and USDC.

In return, LPs are rewarded with a portion of the trading fees generated by users swapping tokens, with some platforms also offering additional tokens, such as governance tokens — i.e veCAKE on PancakeSwap.

Lenders

Yield farmers can function as lenders by depositing their holdings into lending platforms such as Aave or Compound; this allows borrowing to occur and interest to be paid on the loans. However, it’s important to review the interest rate, as it can fluctuate greatly based on supply and demand.

Stakers

Staking is the process of locking up tokens either flexibly or for set periods to support a blockchain network or liquidity pool. Those who stake their tokens are known as ‘Stakers’ and earn rewards based on the amount and the duration of their stake.

Borrowers

Borrowers collateralize their cryptocurrency holdings to obtain loans in another token, allowing them to use their assets for additional yield farming opportunities. However, this process involves significant risk, as borrowers must carefully manage their collateral to avoid liquidation, which could result in the loss of their assets.

How Does Yield Farming Work?

At its core, yield farming is powered by smart contracts that automatically manage liquidity provision, borrowing, and lending.

- Liquidity Provision: Users deposit pairs of tokens (i.e. ETH/USDT) into a liquidity pool on a DEX or lending platform. This pool then enables trading of those assets and users receive LP tokens representing their share of that pool.

- Rewards System: LPs earn rewards for providing liquidity on their chosen DEX or lending platform to earn a share of transaction fees or governance tokens. For example, receiving 0.3% of all transaction fees based on their share of the pool.

- Compounding Strategies: Some yield farmers reinvest their earned tokens to maximize returns, this is known as a compounding strategy. This common practice is done manually or automatically via yield aggregators to ensure optimal compounding of the investment.

Common Yield Farming Strategies

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend their assets for interest or borrow against them as collateral; borrowers often reinvest the funds they borrow to take advantage of higher-yield opportunities. This comes at the cost of increasing their exposure to liquidation risks.

- Liquidity Mining: Liquidity mining involves earning platform-native tokens, such as UNI on Uniswap, by depositing liquidity into the platform’s associated pools. These tokens can provide governance rights and allow users to participate in decision-making processes on the platform.

- Staking: Users staking assets in staking pools or via a specific blockchain network earn annual percentage yield (APY) based on their stake and period of staking. Most DEXs allow users to stake but many centralized exchanges such as Binance, Kraken, and others now also provide staking services.

Popular Yield Farming Platforms